Funds

Rely on our decades-deep expertise in responsible investing, which is woven into every one of our funds. Choose from a wide range of strategies to help build a diverse portfolio.

Separately Managed Accounts

Separately managed accounts (SMAs) offer high-net-worth investors personalized strategies, flexibility and tax efficiency. Unlike some other investment options, you directly own the securities within an SMA so you have more control over your investments and more options for customization.

Featured SMAs

Calvert Equity SMA

Invests primarily in established large-cap growth stocks with a history of sustained earnings growth at a favorable price; the Calvert Principles for Responsible Investment provide a framework for the evaluating ESG factors and engaging with company management teams.

Calvert International Equity SMA

Invests primarily in stocks of non U.S. large-cap companies whose market capitalization falls within the range of the MSCI EAFE Index; the Calvert Principles for Responsible Investment guide the investment research process and decision making.

Calvert U.S. Large-Cap Core Responsible Index SMA

Tracks the Calvert U.S. Large-Cap Core Responsible Index, which is derived from the largest 1,000 companies in the U.S. equity market; offers broad exposure to companies that meet the Calvert Principles for Responsible Investment.

Calvert Research Indexes

The Calvert Research Indexes include companies with strong sustainability profiles that, collectively, may have the potential to meet or exceed the performance of the common broad-market benchmarks.

Building on the more than 20-year heritage of the Calvert US Large-Cap Core Responsible Index (formerly named the Calvert Social Index), Calvert offers a range of proprietary benchmarks.

Featured Indexes

Calvert U.S. Large Cap Diversity Research Index (CALDEI)

The Calvert US Large-Cap Diversity Research Index (CALDEI) is composed of companies that operate their businesses in a manner that is consistent with the Calvert Principles for Responsible Investment and are selected from the universe of the 1,000 largest publicly traded US companies by market cap.

Calvert US Large-Cap Growth Responsible Index (CALGRO)

The Calvert US Large-Cap Growth Responsible Index (CALGRO) is composed of companies that operate their businesses in a manner that is consistent with the Calvert Principles for Responsible Investment (the “Calvert Principles”) and is a subset of the Calvert Large Cap Core Responsible Index.

Calvert US Large-Cap Value Responsible Index (CALVAL)

The Calvert US Large-Cap Value Responsible Index (CALVAL) is composed of companies that operate their businesses in a manner that is consistent with The Calvert Principles for Responsible Investment (the “Calvert Principles”) and is a subset of the Calvert Large Cap Core Responsible Index.

Responsible Allocation Models

A portfolio consisting exclusively of underlying Calvert funds provides a more singular and straightforward approach to ESG investing than one consisting of multiple investment managers and approaches. Calvert Responsible Allocation Models offer three advantages for building diversified portfolios while pursuing competitive returns and positive impact.

Featured Models

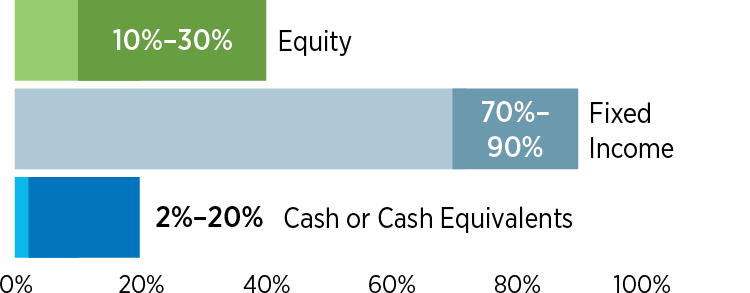

Calvert Responsible Income with Capital Preservation Model

Objective

Income, consistent with preservation of capital

Target Asset Class Ranges

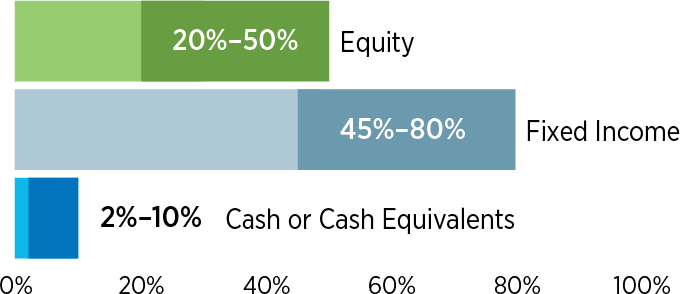

Calvert Responsible Conservative Model

Objective

Current income and capital appreciation, consistent with the preservation of capital

Target Asset Class Ranges

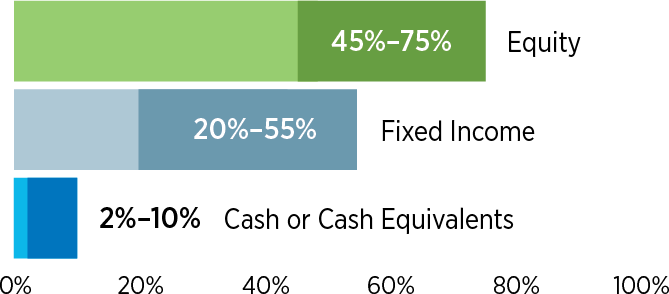

Calvert Responsible Moderate Model

Objective

Long-term capital appreciation and growth of income, with current income a secondary objective

Target Asset Class Ranges

Calvert Responsible Growth Model

Objective

Long-term capital appreciation

Target Asset Class Ranges

Calvert Responsible Aggressive Growth Model

Objective

Long-term capital appreciation

Target Asset Class Ranges

The models are subject to asset allocation risk, which is the chance that selection of, and allocation of assets to, the underlying funds will cause the models to underperform. The Calvert Responsible Allocation Models differ by the percentage invested in equity funds versus fixed-income funds and cash equivalents. Each model shares the principal risks of each underlying fund in which it invests and pays a proportionate share of the operating expenses of those funds. The greater the degree of investments in underlying equity funds, the higher the potential volatility and risk of the responsible allocation model. Thus, Calvert Responsible Growth Model may experience more price fluctuations and involve greater risk than Calvert Responsible Moderate Model, which in turn may experience more price fluctuations and involve more risk than Calvert Responsible Conservative Model. Investing primarily in responsible investments carries the risk that, under certain market conditions, the funds may underperform funds that do not utilize a responsible investment strategy.